Worldwide, the mobile gaming industry continues to go from strength to strength at a time when even the traditionally recession-proof entertainment industries have been feeling the bite. Currently, over 100 million people worldwide are playing mobile games on a tablet or smartphone, with a further 250 million engaged in social gaming via Facebook. That’s approximately 1/15th of the entire population of earth. And the number is only going to keep growing.

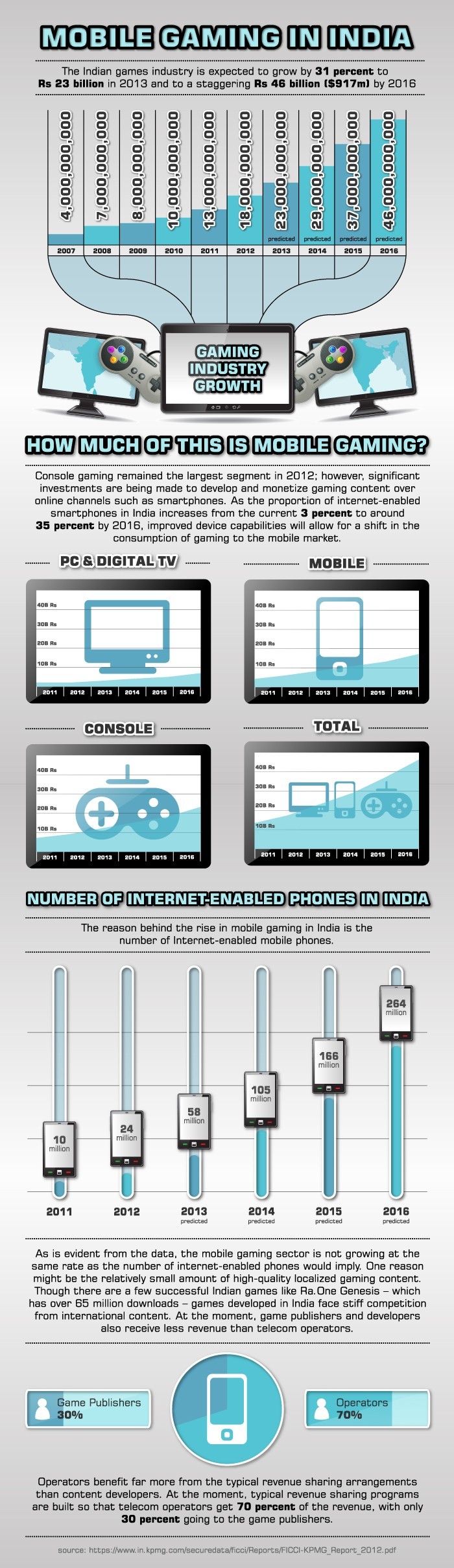

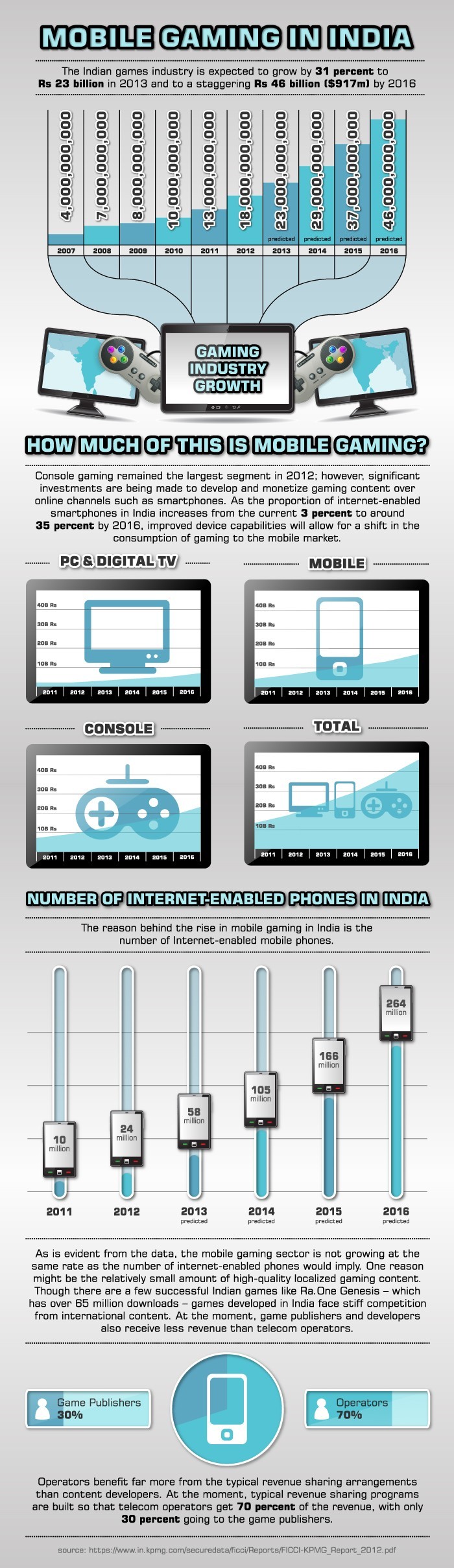

What’s happening with mobile gaming in India? This infographic provides interesting information and analysis. Let’s look at the state of gaming in India. India is currently experiencing a massive economic surge, and this is reflected in the expansion of its gaming sector. As you’ll see from the graph, the value of the gaming market in India has more than quadrupled in since 2007, and shows no signs of stopping. Although the balance of this value comes from the PC, laptop, and console markets, mobile marketing represents the biggest and most exciting source of growth. Presently, around 10 million Indians have access to mobile internet, and this segment is expected to have increased hugely by 2016, when the number of internet enabled smartphones is projected to have increased from 3 percent to 35 percent. Between 2010 and 2011, the mobile gaming market increased in size by 55 percent, and is set to almost quadruple by 2016, increasing its total value from 4.6bn Rupees to 18bn in just four years.

This is all good news for the gaming market, but it isn’t all plain sailing. As mentioned above, the relatively tiny number of internet-capable smartphones in India has artificially limited the growth of this market. But it isn’t the only thing holding back the tide. Although eager to embrace the mobile market, Indian programmers and publishers experience stiff competition from the more mature mobile gaming sector in the west. Its higher quality output represents a real threat to the efforts of local producers. While there have been some examples of home-grown viral successes in the manner of hugely successful western games such as Angry Birds and Cut the Rope (notably Ra.One Genesis), Indian developers are being forced to match the international offerings toe-to-toe in order to attract a profitable audience.

Mobile gaming in India is also unusually fragmented. A multitude of platforms across various tablet and smartphone providers, combined with a low barrier to entry, has resulted in a proliferation of incompatible systems. It has also engendered a much more intense level of competition than is seen in the west. However, the main stunting force on the market is likely the fact that the mobile market in India does not have as advanced a set of revenue streams as the west. This means that the only way for most developers and publishers to extract money from ‘freemium’ and pay-to-play mobile games is through their network carrier. Network carriers are fully aware of this, and most revenue-sharing agreements are heavily biased in their favour. This frequently makes it impossible for developers to make a profit on their offerings, reducing the impetus and ability to create content at the high standard that the market demands.

Mobile Gaming in India: An Infographic

Posted by

admin

May 7, 2013

October 27, 2019

Shares

What’s your reaction?

Shares

admin

Latest Stories

Subscribe Newsletter

Get our latest news straight into your inbox.

Please accept the terms of our newsletter.

Please input your email address.

That email is already subscribed.

Your address has been added.