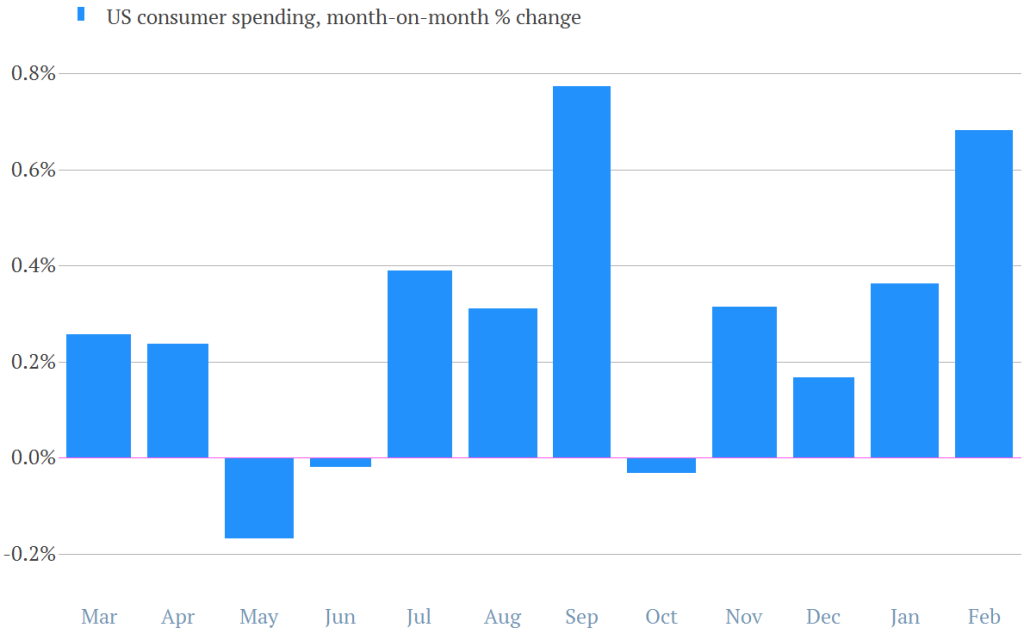

Consumer spending in the United States rose by less than the prediction made in July as the growth in income slowed down. This was an indication that more employment was needed so as to sustain the purchases of the household. The consumer purchases, accounting for 70% of the economy, increased by 0.1% after a revision of 0.6% rise the previous month which was higher than it had been estimated. This is according to the Department of Commerce. In a Bloomberg survey, the median forecast by economists called for an increase by 0.3% but the incomes increased by 0.1% from 0.3 % in the previous month.

A larger pickup in the wage gains and the growth of jobs is needed so as to help the consumers spending to prevail over the weak worldwide demand. The increasing mortgages rates have threatened to upset the household buying of automobiles and appliances, which have sustained the retailers for home improvement such as Home Depot Inc and Lowe’s Co. Gaus Fauncher, an PNP Financial Services Group Inc senior economist, says it is hard for the consumers to increase their spending while they are worried about the labor market stability and whether or not they are going to be in employment.

A larger pickup in the wage gains and the growth of jobs is needed so as to help the consumers spending to prevail over the weak worldwide demand. The increasing mortgages rates have threatened to upset the household buying of automobiles and appliances, which have sustained the retailers for home improvement such as Home Depot Inc and Lowe’s Co. Gaus Fauncher, an PNP Financial Services Group Inc senior economist, says it is hard for the consumers to increase their spending while they are worried about the labor market stability and whether or not they are going to be in employment.

The stock prices also fluctuated, with the S&P 500 index (SPX) on its way towards the largest monthly loss since May of 2012. This is after the release of consumer data and the easing of concerns over the Syria situation. The SPX increased by less than 0.1% to reach 1,638.83 in New York. In the Bloomberg survey that included 74 economists, the forecast on the spending varied between no change and an increase of 0.5%. The reading for the month of June had been previously reported as an increase of 0.5%. The median for the survey called for an incomes’ gain of 0.2%

The Commerce Department reported that the GDP experienced a growth of 2.5% annually in the 2nd quarter of the year after an increase of 1.1% in the 1st quarter. The consumer spending in the 2nd quarter rose by 1.8% annualized rate following a 2.3% rate in the first quarter of the year according to the released figures. After the consumer spending was adjusted for inflation, the figures showed that the purchases were unchanged in the month of July in comparison with an increase of 0.2% in the month of June. The price index of the Commerce Department tied to the spending, a measure followed by the policy makers of the Federal Reserve, rose by 1.4% in the month of July 2013 from the same time in 2012.

Increase in employment would help to compel the increase in wages needed to improve the purchases for the household. According to the Bloomberg survey, the employers most likely employed 180,000 more people in the month of August, in advance of the Labor Department report on 6th of September. In the first half of the year, the gain in hiring was at a monthly average of 197,500 which is an increase from the 180,000 average in the last six months 2012.